Many folks look for ways to get what they need without paying all at once. It makes sense, too, that sometimes a big purchase feels much better when you can spread out the cost. Fingerhut has been a name many people know for this kind of shopping. It lets you buy things and pay them off over time, which is really helpful for managing your money, you know?

But, as a matter of fact, Fingerhut is not the only place that offers this kind of buying experience. There are quite a few other online stores that work in a way very similar to Fingerhut. These places understand that people sometimes need a little extra help with payments, or maybe they want to build up their credit score a bit. It is a common need for many shoppers.

So, if you are looking for more options, or just want to see what else is out there, you are in the right spot. We are going to look at some of these other spots that are, in some respects, just like Fingerhut. You might find a new favorite place to shop for things like home goods, electronics, or even clothes, all with payment plans that fit your life. It is pretty cool, honestly.

Table of Contents

- Understanding What Fingerhut Offers

- Why Look for Other Places Like Fingerhut?

- Top Spots Similar to Fingerhut

- How to Pick the Right Spot for You

- FAQs About Shopping with Payment Plans

- Making Smart Choices for Your Wallet

Understanding What Fingerhut Offers

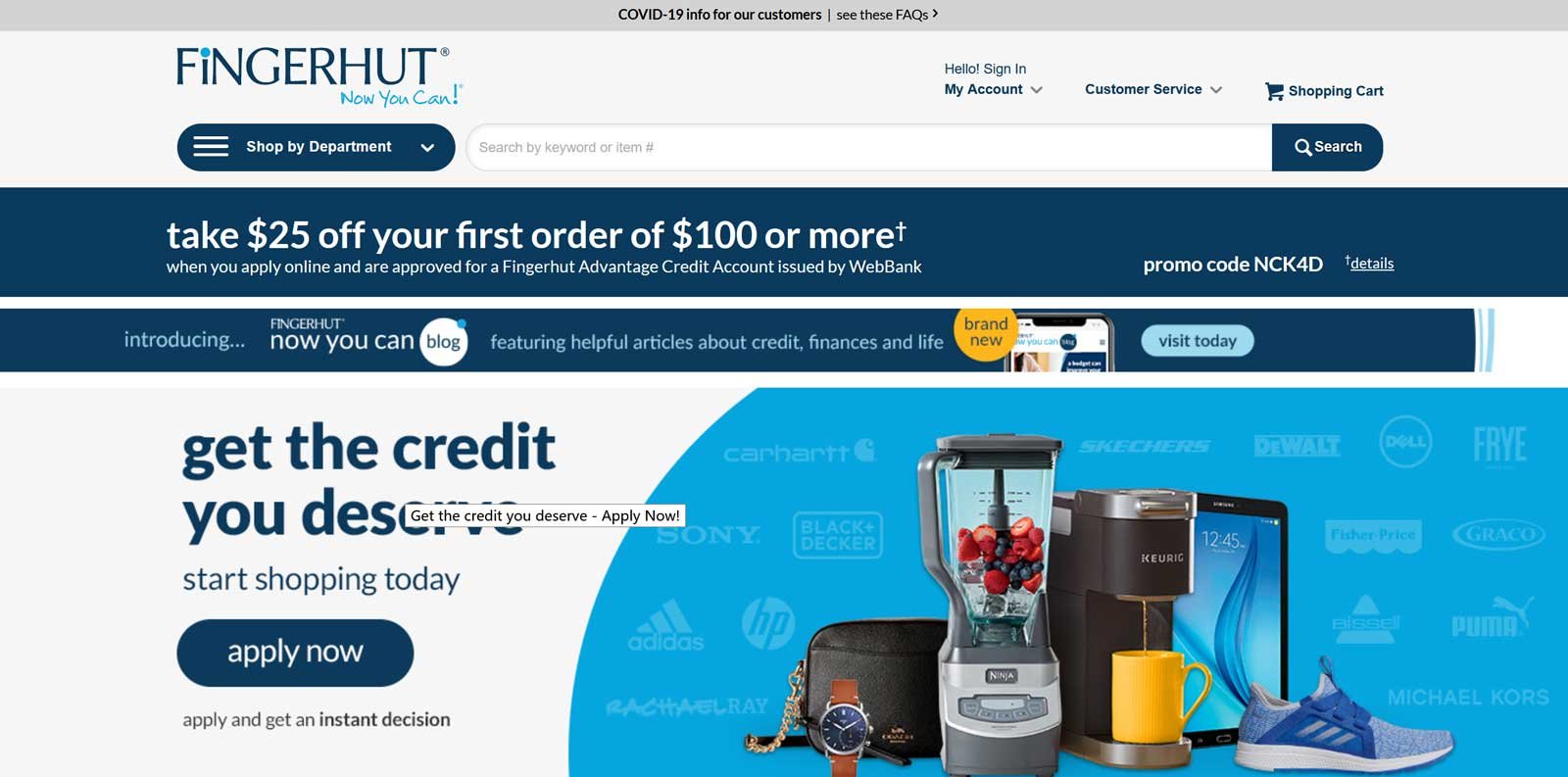

Fingerhut is, in a way, a bit like a catalog store from years ago, but it is all online now. They give people a chance to buy things and pay for them over a stretch of time. This can be really good for someone who might not have a perfect credit history, or who just prefers to pay in smaller amounts. They sell a lot of different items, everything from furniture to electronics and even jewelry, so there is quite a range. They typically offer their own credit account, which is how the payment plans work, so that is how they do it.

The idea behind it is pretty simple. You pick out what you want, and then you apply for a credit account with them. If you get approved, you can make your purchase and then pay it off with regular, smaller payments. This can be a very useful way to get things you need without having to save up the whole amount first. It is, you know, a different way to shop for sure.

Many people use Fingerhut to help build their credit, too. By making payments on time, it can show that you are responsible with money, and that can help your credit score go up. This is a big draw for some people, as a matter of fact. It is a pretty straightforward system, and that is why so many people have used it over the years.

Why Look for Other Places Like Fingerhut?

Even though Fingerhut is a known name, there are good reasons to check out other places that are similar. Maybe you did not find exactly what you were looking for there. Perhaps the payment terms did not quite fit what you needed. Or, it could be that you just want more choices, which is a very common thing for shoppers. It is always good to have options, right?

Some people might find that the prices at Fingerhut are a bit higher than other stores. This can happen because they offer those payment plans, and that service costs money. So, looking around might help you find the same item for a bit less money, or with better payment terms. It is worth checking, anyway.

Also, different stores will have different rules about who they give credit to. If you did not get approved at one spot, another place might say yes. That is just how these things work, you know. So, having a list of places similar to Fingerhut gives you more chances to get what you want or need.

Different Products and Prices

One big reason to look around is the variety of items. While Fingerhut has a lot, another store might specialize in something you really want, like a specific type of electronics or a certain brand of clothes. They might also have different sales or deals going on, which could save you money. It is just like shopping at different grocery stores for different items, really.

Prices can change a lot from one store to another, even for the exact same item. A place similar to Fingerhut might have a lower price tag, or they might offer different payment plans that work out cheaper in the long run. It is always a good idea to compare, just a little. You could save a fair bit of money by doing so.

And, of course, some places might just have a better selection of the things you are interested in. If you are looking for something very specific, you might have better luck at a store that focuses on that kind of item. It is, you know, about finding the right fit for your shopping needs.

More Credit Options

Not every store offers the same kind of credit. Some places might have their own credit card, very similar to how a department store does it. Others might link up with a buy now, pay later service, which is a bit different. Each one has its own rules about who can get approved and what the interest rates will be. So, more options mean more chances for you.

If you are trying to build your credit, some places might report your payments to all the big credit bureaus, while others might not. That is a pretty important detail if your goal is to help your credit score grow. So, you know, it pays to check these things out beforehand.

And, really, some payment plans are just better than others. You might find a place that offers zero interest for a certain time, or has lower monthly payments that fit your budget better. It is about finding the plan that feels right for you, honestly.

A Fresh Shopping Experience

Sometimes, it is just nice to try something new. A different website layout, a new way to browse items, or even just a different range of products can make shopping more fun. It is like trying a new restaurant, in a way. You might discover something you really like.

Some of these other places might have special features, too. Maybe they have a rewards program, or they offer free shipping on certain orders. These little extras can make a big difference in your overall shopping experience. It is worth exploring, apparently.

And, of course, you might find a store that just feels better to use. The website might be easier to navigate, or their customer service might be more helpful. These small things can really add up and make you prefer one store over another, you know.

Top Spots Similar to Fingerhut

There are quite a few places that offer ways to pay over time, much like Fingerhut. They might do it in slightly different ways, but the main idea is the same: you get what you need now, and you pay for it later. We can look at a few common types of these places. It is pretty interesting to see the variety, really.

Some of these spots are big retailers that have their own credit cards. Others use newer services that let you split your payments at checkout. And then there are places that let you lease an item with the option to own it later. Each one has its own feel and its own set of rules, so it is good to know the differences.

So, here are some of the popular kinds of places you might want to check out. They are all, in a way, trying to make shopping more accessible for people who want payment flexibility. It is a growing trend, as a matter of fact.

Retailers with In-House Credit

Many big stores have their own credit cards, very similar to how Fingerhut offers its own credit. These cards usually let you buy things from that specific store and pay them off over time. Think of places like Macy's, Kohl's, or JCPenney. They often have special deals for cardholders, too.

Getting approved for these store cards can sometimes be a bit easier than getting a regular bank credit card, especially if your credit score is not super high. They are looking to keep you as a customer, so they might be more willing to work with you. This can be a good starting point for building credit, you know.

However, it is pretty important to remember that these cards usually have higher interest rates than regular credit cards if you do not pay them off quickly. So, it is a good idea to pay your balance as fast as you can to avoid those extra charges. Always read the terms, basically.

- Examples:

- Overstock: Offers a credit card for furniture, home goods, and more.

- HSN (Home Shopping Network): Has its own credit card, very similar to QVC.

- QVC: Another shopping channel with its own credit card for various products.

- Montgomery Ward: A name from the past that still operates online, offering credit accounts.

Buy Now, Pay Later Services

These services are a bit newer and have become very popular. They let you split your purchase into several smaller payments, often four, with no interest if you pay on time. You typically see them as an option when you are checking out online, like a payment choice. Places like Affirm, Afterpay, and Klarna are good examples of these services.

The nice thing about these is that they often do not do a hard credit check, which means applying for them usually does not hurt your credit score. This makes them very accessible for many people. It is a quick and easy way to spread out a payment, you know.

You usually pay the first part of your purchase right away, and then the rest are paid every two weeks or once a month. It is a pretty straightforward system. Just make sure you can make those payments on time, because late fees can add up quickly, obviously.

- Examples:

- Affirm: Partners with many online stores for larger purchases, often with interest for longer terms.

- Afterpay: Common for fashion and beauty, usually splits payments into four, interest-free.

- Klarna: Offers different payment plans, from four interest-free payments to longer-term financing.

- Sezzle: Another popular option for splitting payments, often interest-free.

- Zip (formerly QuadPay): Allows you to split purchases into four payments over six weeks.

Lease-to-Own Options

Lease-to-own places are a bit different from the others. With these, you are not really buying the item right away. Instead, you are renting it with the option to buy it later. This can be good for big items like appliances or furniture. Places like Rent-A-Center or Aaron's work this way, for instance.

These places usually do not check your credit score at all, or they do a very light check. This makes them very accessible for people who have trouble getting credit anywhere else. You make weekly or monthly payments, and after a certain number of payments, the item is yours. It is a very different kind of agreement, in a way.

However, you need to be very careful with these options. The total cost of the item can end up being much, much higher than if you bought it outright. You are paying for the convenience and the lack of a credit check. So, always compare the total cost to what the item would sell for in a regular store. It is a big thing to consider, really.

- Examples:

- Rent-A-Center: Offers furniture, appliances, and electronics with lease-to-own plans.

- Aaron's: Very similar to Rent-A-Center, providing lease-to-own options for home goods.

- FlexShopper: An online platform that connects you to retailers offering lease-to-own plans.

How to Pick the Right Spot for You

Choosing the best place that is similar to Fingerhut depends on what you need and what you are comfortable with. It is not a one-size-fits-all kind of thing, you know. There are a few things you should think about before you make a choice. It is about making a smart decision for your money, basically.

You should always look at the details, not just the big promises. Sometimes, a deal that looks great on the surface has hidden costs or terms that are not so good. So, taking a little time to compare can save you a lot of trouble later. It is pretty important, honestly.

Think about what you are buying, how much you can pay each month, and what your goals are. Are you trying to build credit? Do you just need something right now and want to pay it off slowly? Your answers to these questions will help guide you, as a matter of fact.

Check the Interest Rates

This is probably the most important thing to look at. Interest rates tell you how much extra money you will pay on top of the item's price. A high interest rate can make a small purchase turn into a very expensive one over time. Some places offer zero interest if you pay within a certain period, which is great, but others can be very high. So, you know, always ask about the interest.

For buy now, pay later services, many of them offer interest-free payments if you pay on time. This is a big plus. But if you miss a payment, they can sometimes add fees or interest, so be careful. It is pretty straightforward if you just stick to the plan.

For in-house credit cards or lease-to-own, the interest or total cost can be quite high. Make sure you know the total amount you will pay over the life of the payment plan. It is a really big number to keep in mind, you see.

Look at the Product Selection

Does the store actually have what you want or need? Some places might be great for electronics but not so good for clothes. Others might have a wide variety, very similar to a general store. Make sure the store fits your shopping list. It is pretty simple, but sometimes overlooked.

Also, think about the quality of the products. Are they brands you trust? Do they have good reviews? Just because you can pay over time does not mean you should settle for something that will not last. You want your purchase to be worth it, basically.

Sometimes, a store might specialize in certain types of goods. If you are looking for a new sofa, a furniture store with payment plans might be better than a general merchandise store. It is about finding the right fit for your specific needs, you know.

Read the Fine Print

This means reading all the terms and conditions before you agree to anything. What are the late fees? What happens if you miss a payment? Can you pay off the balance early without penalty? These are all important questions. It is not the most exciting part, but it is super important, honestly.

Some agreements might have hidden fees or clauses that could surprise you later. Make sure you understand everything before you sign up. If something seems unclear, ask questions. It is your money, after all, so you should know where it is going. This is a very big step.

It is very similar to signing any other kind of agreement. You would not sign a lease for a house without reading it, right? This is the same idea, just for shopping. It is a good habit to get into, basically.

Customer Service Matters

What if something goes wrong with your order or your payment? You want to know that you can get help. Look for reviews about a company's customer service. Do people say they are helpful and easy to reach? This can make a big difference if you run into a problem. It is a really important thing, actually.

A good customer service team can help you with payment issues, returns, or questions about your account. A bad one can make a simple problem feel like a huge headache. So, a little research into this can save you a lot of frustration. It is something to consider, you know.

You can often find reviews online that talk about how a company treats its customers. This can give you a good idea of what to expect. It is pretty easy to do a quick search, anyway.

FAQs About Shopping with Payment Plans

Can I get approved for these sites with bad credit?

Many places similar to Fingerhut do offer options for people with less-than-perfect credit. Some, like lease-to-own companies, often do not even check your credit score. Buy now, pay later services also tend to be more forgiving than traditional credit cards. However, approval is never guaranteed, and it really depends on the specific store and your situation, you know.

Do these sites help build my credit score?

Some of these sites, especially those offering their own credit cards or accounts, do report your payment history to credit bureaus. Making on-time payments can definitely help improve your credit score over time. It is important to check if a specific store reports to credit bureaus if building credit is your main goal. Not all of them do, so, you know, it is good to ask.

Are the prices higher on these sites?

Often, yes, the prices on sites that offer payment plans can be a bit higher than what you might find at a regular cash-and-carry store. This is because the store is taking on more risk by letting you pay over time, and they are providing a service. You are paying for the convenience of spreading out your payments, so, you know, it is something to consider. Always compare prices before you buy, obviously.

Making Smart Choices for Your Wallet

Finding places similar to Fingerhut can open up a lot of shopping possibilities, especially when you need flexible payment options. There are so many choices out there now, from stores with their own credit to popular buy now, pay later services. Each one has its own good points and things to watch out for. It is pretty cool to have all these choices, honestly.

The main thing is to be a smart shopper. Always look at the total cost, not just the monthly payment. Understand the interest rates, if there are any, and make sure you can really afford the payments. Doing a little bit of homework can save you a lot of money and stress in the long run. It is very similar to planning any other big purchase, really.

So, take your time, compare your options, and pick the place that best fits your needs and your budget. This way, you can get the things you

Detail Author:

- Name : Ms. Dulce Rau I

- Username : titus.labadie

- Email : berdman@hotmail.com

- Birthdate : 2004-11-30

- Address : 3565 Barton Run Apt. 924 Woodrowton, AK 85571

- Phone : 775.692.4342

- Company : Feeney-Erdman

- Job : Forensic Investigator

- Bio : Voluptas tempore recusandae eos labore unde. Cum voluptates aut nobis et alias autem recusandae. Et vitae eius reiciendis quisquam ex. Sit illo ipsum hic unde neque sit.

Socials

twitter:

- url : https://twitter.com/collinsj

- username : collinsj

- bio : Autem saepe ad provident labore et doloribus expedita. Ut quibusdam fugit impedit dolores.

- followers : 4827

- following : 385

tiktok:

- url : https://tiktok.com/@jenifercollins

- username : jenifercollins

- bio : Sit at nobis porro voluptatibus.

- followers : 5391

- following : 2691